[ad_1]

Following CIPA data for the last 3 years has been akin to watching a train wreck at 240 fps. But it appears as if the train has finally stopped – at least for now.

The industry as a whole seems to be reaching a steady state, with overall ILC (interchangeable lens cameras) shipments up to and including August 2023 sitting at 3,748,096 units. Mirrorless is the main driver now and is steadily increasing its market share percentage over the DSLR with 79% of the units shipped now being mirrorless cameras up 22% from August 2022. DSLRs continue their slide as both Canon and Nikon ignore their legacy mounts completely and work on their new mirrorless systems. Given the rise of mirrorless, even with the overall rapid decline in DSLR, the entire market is around the same as it was last year with 102% of the units and shows a modest 109% increase of value from the first 8 months of last year.

If we start drilling into the regional markets, China has shown impressive growth so far this year making up nearly 50% of the entire Asian market to become the third-largest ILC camera market overall, and the largest mirrorless market in the world so far this year. They aren’t just purchasing cheap mirrorless cameras either, as by units, China makes up 26% of the global units shipped, but 29% of the total unit value shipped. This means that overall the per unit value of the mirrorless cameras being shipped into China is more than in other regions. Surprisingly this even holds true when comparing against the overall Americas market, which is usually the higher per unit value market. China now exceeds the Americas market mirrorless value by 12% per unit.

Breaking down the unit shares across the various regions for what remains of the DSLR market we can see that the market is pretty much dominated by Europe and the Americas with surprisingly Europe holding the greater share of the DSLRs shipped.

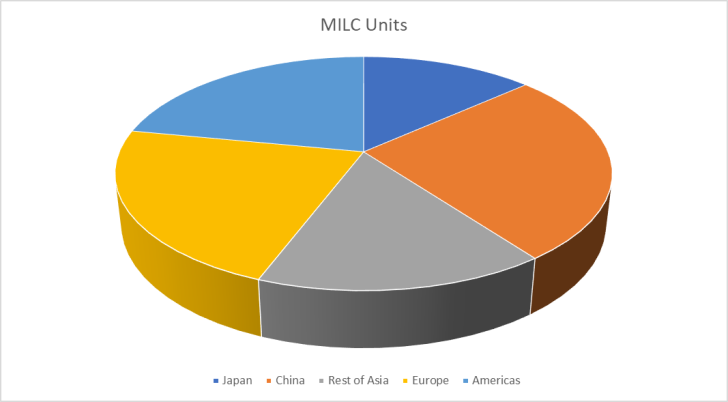

If we look at the MILC (Mirrorless Interchangeable Lens Cameras) we can see that the market is more distributed evenly across all the reporting regions.

If we lump all of Asia together and look at specifically the most competitive market, the MILC market we see that Asia accounts for approximately 55% of all unit shipments with Americas and Europe equally picking up the remainder.

What does this mean to us? Well, it’s hard to predict where the market would have been if Covid never happened so that distorts CIPA year-on-year statistics dramatically from the lack of sales during the shutdowns, the economic recovery, supply chain issues, and the rampant inflation experienced after the pandemic by most of the world. It’s hard to say that the camera industry is at fault for mismanaging their businesses over the last 3 years given all the difficulties.

It’s clear that China is the market presence and that overall mirrorless Asia holds the dominant position for mirrorless with a commanding control of 55% of the market. For that reason, we can easily assume that the camera manufacturers will be certainly looking at exploiting those markets more with products continued to be tailored for the Chinese and Asian markets.

Source: CIPA

Some of our articles may include affiliate links. If you purchase through these links, we may earn an affiliate commission at no extra cost to you.

….

[ad_2]

Source link